🚀 Portable does more than just ELT. Explore Our AI Orchestration Capabilities

Data Analytics in EMEA - 2023 VC Market

The EMEA data VC landscape

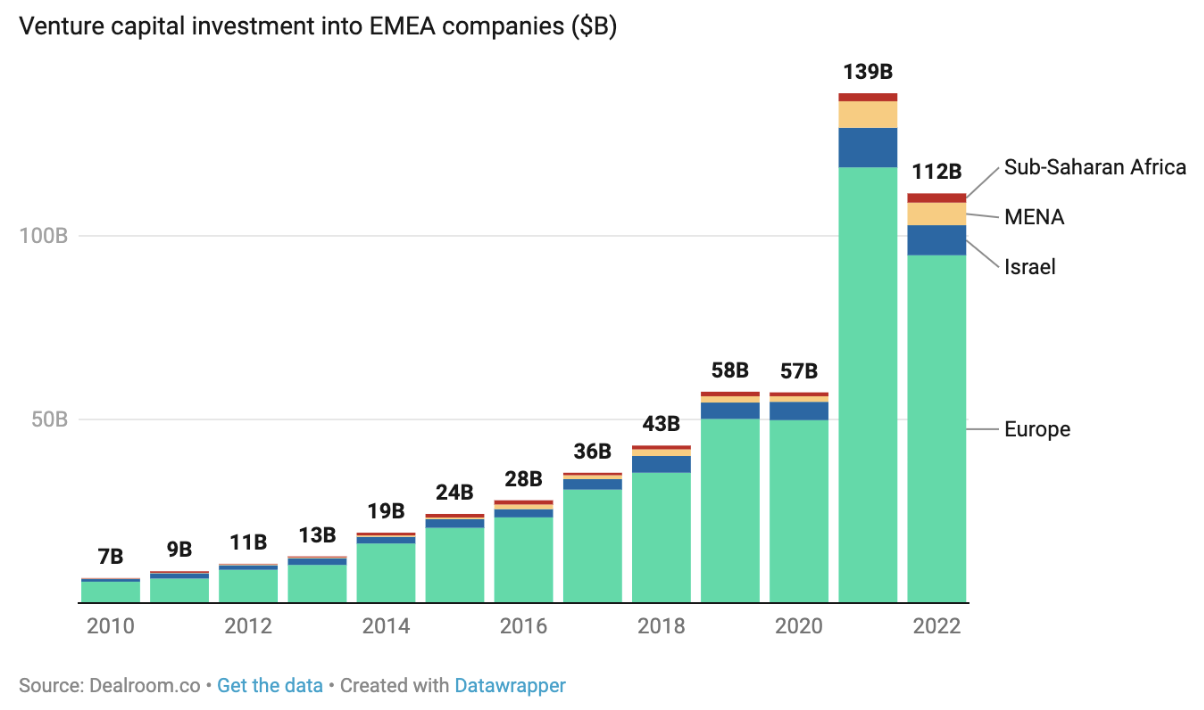

Europe, the Middle East, and Africa are home to many of the top startup hubs, centralized in cities such as London, Paris, and Tel Aviv. In recent years, the region has been experiencing a surge in venture capital investment for startups in the Data space. In 2021, the region saw a record-breaking $45.9 billion in venture capital investment across all sectors, with a significant portion going to data oriented startups.

When viewed at a global level, there has been a decline in venture capital investment since the peak of 2021. However, the impact in EMEA has been comparatively less severe than in North America and the rest of Asia. Specifically, while North America and Asia experienced a 34% and 38% decline in VC investment, respectively, EMEA saw a more modest decrease of only 19%.

Famous data companies located in EMEA:

- Matillion

- Collibra

- Attacame

- Firebolt

- Alooma

- Dataiku

Trends in VC investing for EMEA startups

One of the standout trends in EMEA's venture capital landscape for data startups is the increasing prevalence of corporate venture capital. More and more large corporations are setting up their own venture capital arms to invest in startups that align with their strategic goals. This trend is particularly evident in the data sector, where companies are looking to invest in startups that can provide them with access to new data sources, technologies, and insights.

In addition to corporate venture capital, EMEA has also seen a rise in the number of early-stage venture capital firms that specialize in data startups. These firms are typically smaller in scale and more agile than traditional venture capital firms, and they have a deep understanding of the data sector. This enables them to identify promising data startups at an early stage and provide them with the support and resources they need to succeed.

Examples of VCs that invested in EMEA data companies:

- 83North

- Amiti Ventures

- Earlybird Venture Capital

- Idinvest Partners

- Angular Ventures

"In the past few years, data has become one of the hottest categories to invest in," says Modi Rosen who is the managing Partner at Amiti and Magma ventures. "The trend began in 2015, specifically around big data & AI. Before then data teams were small and in many cases consisted of a small number of database administrators. Today data teams have grown in each organization and therefore investing is still attractive up until these days."

"I don't think this is unique to EMEA'' continues Modi, "I expect that the exposure that chatGPT has done for NLP in consumer products will continue to keep data attractive." When asked about the investment opportunities, Modi believes that 2023 will be the year that we will leave the "shock" of 2022, but keep the valuations to the normativity of pre-covid, what has been referred to as the 'new normal'."

Another challenge for EMEA startups is the highly competitive landscape. With so many startups vying for investment, it can be difficult for new and emerging companies to stand out. To overcome this challenge, startups need to have a clear and compelling value proposition, a strong team with the right skills and expertise, and a clear plan for how they will use the funding they receive.

This is especially true for the early stage AI space which is increasingly becoming the Hottest Startup Investing Trend of 2023, since the release of ChatGPT to the public. Looking at Y Combinator's first 2023 batch as it's released so far (and expected to grow), 51 of the growing 183 are AI startups, 32 of which classify themselves as generative AI.

The dynamic EMEA data landscape

In conclusion, the venture capital landscape for data startups in EMEA is highly dynamic and rapidly evolving. While there are challenges that startups must overcome, there are also significant opportunities for those with innovative ideas and a strong value proposition. As the demand for data-driven solutions continues to grow, we can expect to see continued investment in EMEA data startups, which will help to drive innovation and growth in the region's economy.

About the Author

Avi Greenwald is the Co-Founder & CTO at Aggua, a collaborative data management platform for mid-sized companies which utilize the modern data stack, and provide a suite of solutions including data catalog, lineage & cost management.

Avi enjoys learning and playing around with new data technologies, writing code and helping organizations sort the mess they have created within their data lakes, warehouses & pipelines.